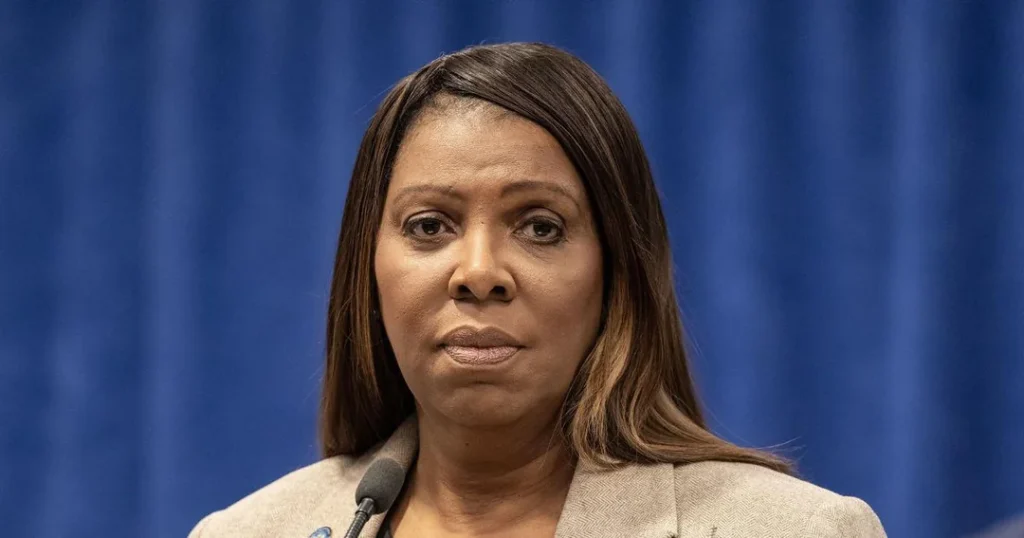

New York Attorney General Letitia James has filed a lawsuit against Early Warning Services, LLC (EWS), the company behind Zelle, alleging that the platform was designed without sufficient safeguards to protect consumers from widespread fraud.

The lawsuit, filed on August 13, 2025, claims that Zelle users collectively lost more than $1 billion between 2017 and 2023 due to scams that exploited vulnerabilities in the platform’s structure. EWS, which is owned and controlled by major U.S. banks including JPMorgan Chase, Bank of America, Wells Fargo, and Capital One, is accused of prioritizing rapid market expansion over consumer protection.

According to the complaint, Zelle was launched in 2017 with minimal verification requirements, allowing fraudsters to create deceptive accounts and impersonate trusted institutions. Because Zelle transfers are immediate and irreversible, consumers often had little to no recourse after being defrauded. In one cited case, a New York consumer transferred nearly $1,500 to an account labeled “Coned Billing” after a scammer posed as a Con Edison employee. The consumer’s bank later refused to reimburse the loss.

The Attorney General’s office argues that EWS and its partner banks knew of systemic fraud issues for years yet failed to adopt even basic safeguards. Although the company developed anti-fraud tools as early as 2019, the lawsuit alleges EWS deliberately delayed implementing them and did not require banks to report or act swiftly on scams.

This legal action comes after the Consumer Financial Protection Bureau (CFPB) withdrew a similar case in December 2024, following a change in the federal administration. By proceeding independently, Attorney General James is seeking restitution for defrauded New Yorkers, damages, and a court order mandating stronger fraud-prevention measures.

“No one should be left to fend for themselves after falling victim to a scam,” AG James stated, underscoring her office’s intention to hold both EWS and its bank owners accountable.

The lawsuit alleges violations of New York’s consumer protection laws, including deceptive business practices, for marketing Zelle as a “safe and secure” platform while knowing it was uniquely vulnerable to fraud.

This case continues James’ aggressive consumer protection agenda. Over the past two years, her office has brought actions against Capital One, Citibank, MoneyGram, and payday lending companies for alleged misconduct ranging from misleading practices to failure to safeguard accounts.

The outcome of this lawsuit could set an important precedent for bank-backed fintech platforms and the degree of legal accountability they bear for consumer fraud. If successful, it may compel structural reforms not only at Zelle but across similar payment networks that prioritize speed and convenience over consumer safety.

Consumers who lost money through Zelle scams are being urged to file complaints with the New York Attorney General’s Consumer Frauds Bureau.