In a major legal setback for the Biden administration’s consumer protection efforts, a Trump-appointed federal judge has overturned a Consumer Financial Protection Bureau (CFPB) rule that would have eliminated medical debt from consumer credit reports—a move that could have raised credit scores for millions of Americans.

U.S. District Judge Sean D. Jordan, who presides over the Eastern District of Texas, ruled on Friday that the CFPB’s finalized regulation exceeded the agency’s statutory authority under the Fair Credit Reporting Act (FCRA).

His opinion determined that the CFPB lacks the legal power to prohibit credit bureaus from including medical debt information in consumer credit histories.

$49 Million in Relief Wiped Out

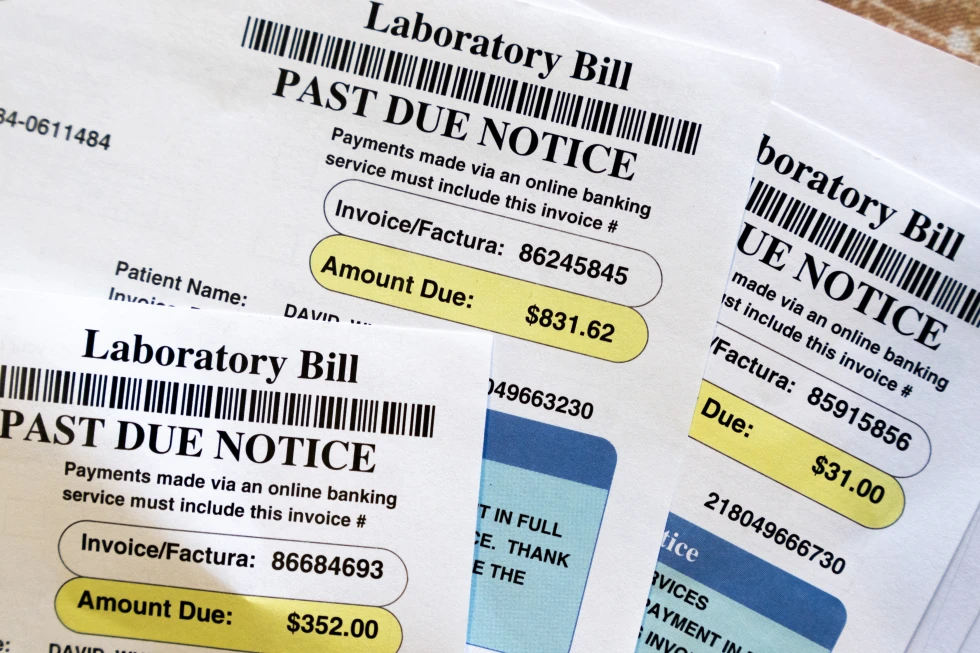

The rule, championed by the Biden administration, was projected to erase $49 million in medical debt affecting approximately 15 million Americans.

The CFPB argued that removing these debts from credit reports would increase the average credit score by 20 points, allowing more families to qualify for mortgages and other forms of credit.

“Medical debt is often a poor predictor of a borrower’s creditworthiness,” the CFPB stated in its supporting research, “yet it remains a leading cause of credit denial, especially for home loans.”

Judge Jordan disagreed, stating the CFPB lacked a statutory basis to dictate what types of debt could be excluded from credit reporting under the FCRA, which governs the use and accuracy of consumer credit data collected by agencies like Equifax, Experian, and TransUnion.

Broader Implications for Financial Access

Under the now-overturned rule, lenders would have been barred from accessing medical debt information, a change that advocates say would have helped reduce racial and economic disparities in credit access.

The CFPB’s data showed that 28% of Black consumers and 22% of Latino consumers have medical debt on their credit reports, compared to 17% of white consumers.

The three major credit bureaus had already begun implementing changes—voluntarily removing medical collections under $500—but the CFPB’s rule would have gone further by eliminating all outstanding medical bills from credit files, regardless of amount or payment status.

Political and Legal Context

This ruling arrives amid ongoing scrutiny of the CFPB’s scope and legitimacy. The agency, which was created after the 2008 financial crisis, has faced sustained opposition from conservative lawmakers and legal scholars who argue it holds too much unchecked authority. Earlier this year, the Trump administration requested the agency pause most of its operations, severely limiting its enforcement capacity.

Legal experts note that the Jordan decision could set a precedent for future challenges to federal regulatory agencies attempting to expand protections under existing law.

“This case underscores a growing judicial trend of narrowing the interpretation of agency authority, especially in areas with broad financial and social implications,” said one consumer finance legal analyst.

What’s Next?

The CFPB has not yet announced whether it will appeal the ruling. However, consumer advocates are urging the agency to fight back, warning that millions of Americans—many still recovering from COVID-era medical bills—will be disproportionately harmed.

In the meantime, medical debt will remain a major barrier to credit access, particularly for marginalized communities.

Unless reversed, Judge Jordan’s ruling ensures that lenders and credit bureaus may continue factoring these debts into creditworthiness decisions, despite growing evidence that such debts are unreliable indicators of financial behavior.