New York trademark attorney Jeremy Green Eche has turned a modest investment into a significant profit with the sale of a domain name he purchased in 2020.

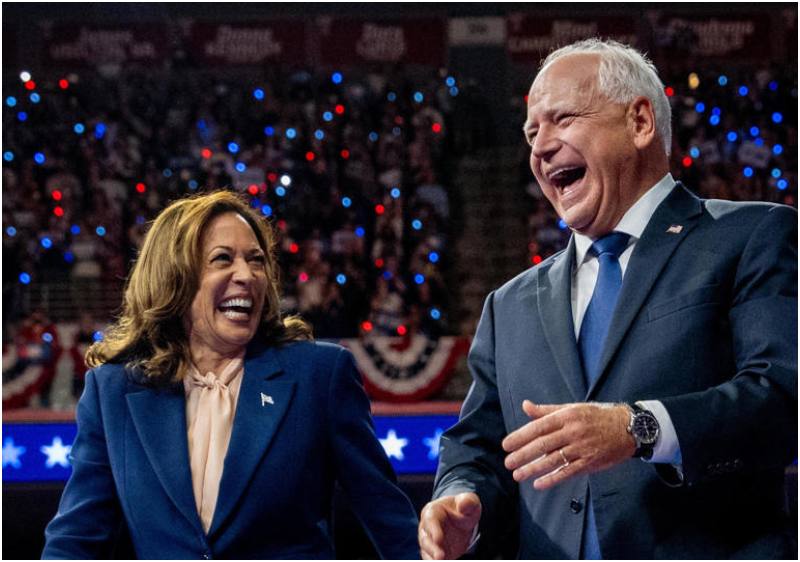

Eche, a supporter of Vice President Kamala Harris, bought HarrisWalz.com for just $8.99, a domain combining Harris’ last name with that of her then-potential running mate, Minnesota Governor Tim Walz.

This week, he sold the domain for $15,000 to an individual buyer, marking a notable success in his domain investing venture.

Eche’s practice of acquiring and selling domain names, also known as domain investing, has yielded substantial returns over the years.

“I buy domain names that consist of combinations of two last names that I hope will end up being a major party’s presidential ticket,” Eche told CBS MoneyWatch. His strategy paid off significantly with the sale of HarrisWalz.com.

The buyer of the domain, an apparent Harris supporter, redirected the site to Kamala Harris’ official campaign page. Eche noted that the buyer is not affiliated with the Harris-Walz campaign.

Despite the high price, the Harris campaign did not make an offer on the domain, and the campaign’s spokesperson did not immediately respond to inquiries about the sale.

Eche, who owns around 60 domains related to potential presidential candidates from both major parties, has experienced previous successes with his domain investments.

Notably, in 2016, he sold Clintonkaine.com for $15,000 to an anonymous buyer, later discovering the purchaser worked for the Trump campaign. Eche repurchased the domain for less than $1,000 to showcase his own comics.

The sale of HarrisWalz.com through Eche’s startup, Communer.com, further shows the lucrative nature of domain investing.

Despite the Harris campaign’s lack of interest, Eche expressed no disappointment, emphasizing that presidential campaigns should invest in securing their domain names.

Eche remains focused on potential future presidential campaigns, holding domains for figures such as Gretchen Whitmer, Tim Walz, and Nikki Haley.

His domain investments highlight the intersection of intellectual property and political forecasting, showcasing how a strategic purchase can lead to substantial financial gain.